Casualty insurance is a highly specialised insurance product and requires many years of on-the-job training to reach a level of proficiency. Currently there is no single source of training or reading material available for this line of work in the South African market.

The financial services sector comprises about 23% of the total formal employment sector in South Africa, of which insurance is a substantial portion, yet skills shortages have plagued the short-term insurance industry for many years. While on-the-job training is the primary method of learning and development in the industry, this, in itself is not always effective due to work pressures and lack of availability of adequately skilled senior staff to dedicate their time to training. The regulatory pressures on companies operating in this space has also increased substantially in the past number of years and the training programmes have not kept pace with the requirements of the job. Qualified graduates also experience a gap between their formal training and the practical requirements of the job.

With the outbreak of the COVID-19 virus in early 2020, the world rapidly changed and exploring new ways of skills development, training and learning are no longer a luxury – they are an imperative. The working environment has rapidly changed, and remote working will become the norm in many companies. While there are many benefits to this, the real medium to long term effects of this will only be felt in years to come. One of the consequences will be the decline in on-the-job vocational training opportunities – especially for young, inexperienced staff. With no formal in-depth, specialised vocational training and development courses and material available in the market this will ultimately have a negative effect on the sustainability of the market as it impacts on the quality of risk decisions that insurance professionals make – affecting their risk carriers and their clients.

This short course in casualty insurance, which is at an advanced level, aims to address this critical skills shortage in the industry by providing graduates, insurance- and legal professionals the opportunity to advance their careers with theoretical and practical, occupationally-relevant online training in casualty insurance practice. It also aims to equip intermediaries (brokers), risk managers, industries and professionals with the necessary tools to effectively identify, assess and manage the various casualty risks to which their clients or the particular profession or industry are exposed to and to give a deeper understanding on how these policies operate, as well as obtain the necessary CPD credits required by their respective industry bodies.

This is a practical hands-on course for all insurance practitioners – be they insurers, brokers, risk managers, loss adjusters or legal practitioners specialising in insurance litigation.

This self-paced online course will be presented in a blended learning format which includes a detailed training manual, videos, infographics and illustrative examples.

Learning outcomes

In this first short course we aim to equip participants with –

- An appreciation of the importance of casualty insurance for businesses and professionals who operate in South Africa

- In-depth knowledge of the different role players in the casualty insurance space

- Appropriate knowledge of the South African law of delict, the law of contract and some selected legislation which have an impact on casualty risks

- An understanding of certain legal and insurance concepts underpinning casualty insurance

- Basic competencies in:

- Identifying the casualty risks which a particular Insured may be exposed to

- Determining which policy is the more appropriate to cover a specific casualty risk

- Analysing and interpreting casualty policy documents (policy schedules, wordings, endorsements, proposal forms, etc.).

- Determining the cover provided under a liability policy, a professional indemnity policy and financial lines policies

Course outline

The course is self-paced and consists of 10 modules. Each module will be assessed online after it has been completed.

Module 1 – Introduction

Module 2 – The role players

Module 3 - The sources of legal liability

Module 4 - Legal and insurance concepts

Module 5 – The reading and interpretation of casualty policies

Module 6 – The common features of the casualty policy documents

Module 7 – An overview of the liability policy

Module 8 – An overview of the professional indemnity (PI) policy

Module 9 – The main differences between PI And liability policies

Module 10 – An overview of financial lines policies

Download a more detailed summary of each module.

Although the course is self-paced, it is recommended that the course be completed within six months of registration. It has an estimated learning time of 38 hours, and on registration and payment, you will be given access to the course for 12 months.

For more information, please read through these frequently asked questions.

Who will benefit from this course?

- Insurance professionals (intermediaries, claims specialists, underwriters) who are already FAIS compliant, who want to advance their careers in casualty insurance products.

- Legal professionals who want to specialise in insurance law and litigation.

- Loss adjusters who want to specialise in casualty claims.

- Risk and insurance managers across a broad range of industries and professionals who require an understanding of insurance and risk management in their specific industry or profession.

The course is structured in such a way that both experienced practitioners and novices will benefit from it.

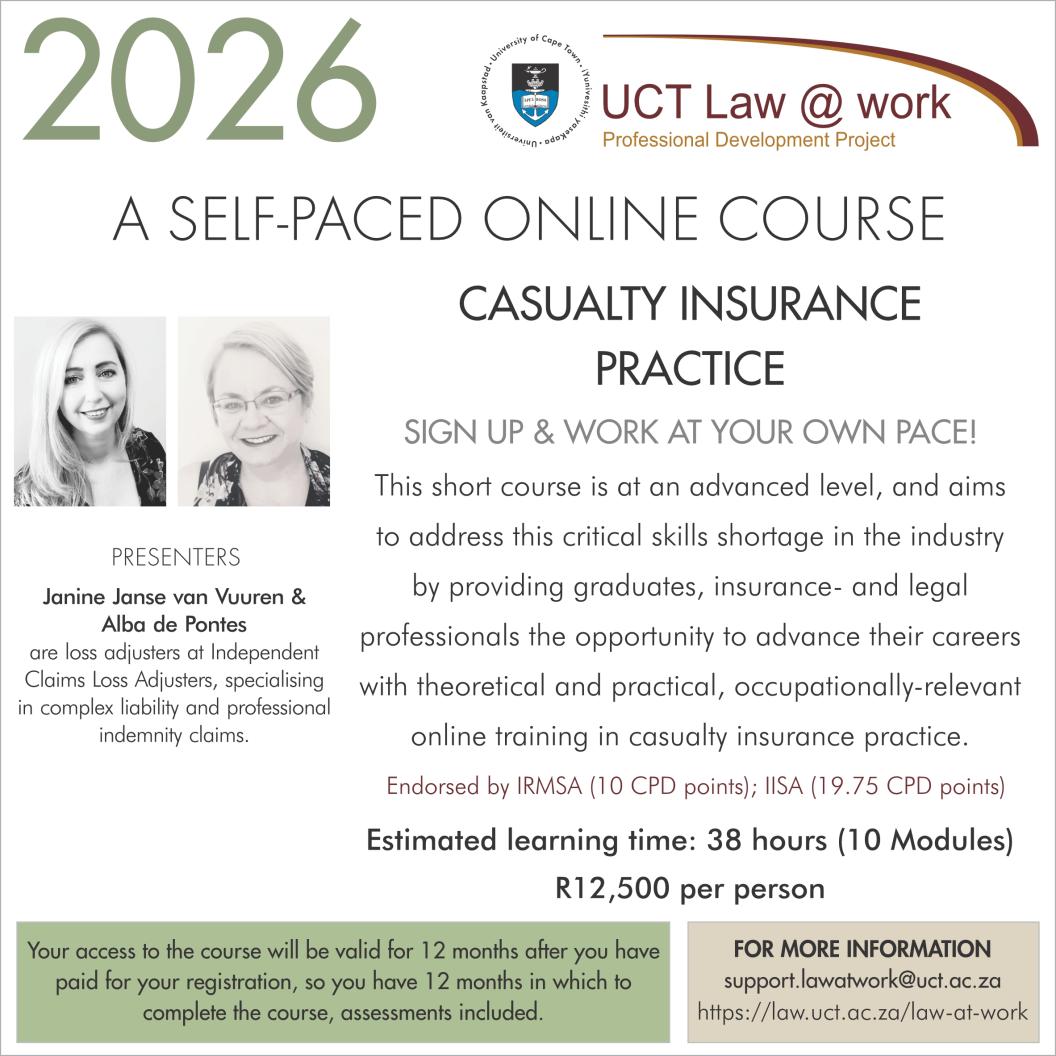

Presenters

Janine Janse van Vuuren and Alba de Pontes are both admitted attorneys who spent many years in practice as litigation attorneys. They have a combined 28 years of experience in the casualty insurance space and spent many years in the insurance industry in senior roles at a leading underwriting manager in the Santam group. They have been involved in strategising and litigating on some of the biggest and most complex casualty insurance claims in South Africa over the past 10 years such as the Greyston bridge collapse of October 2015, the Tongaat Mall collapse in November 2013, the listeriosis outbreak in March 2018 – to name but a few. They have many years of practical hands-on experience in the legal, insurance and technical complexities of running a successful complex claims strategy, claims operations and governance, compliance, claims management and risk assessment. They both currently work as loss adjusters at Independent Claims Loss Adjusters, specialising in complex liability and professional indemnity claims.

When?

The course is self-paced, so you can register at any time and work through the material at your own schedule. The course has an estimated learning time of 38 hours.

Your access to the course will be valid for 12 months after you have paid for your registration, so you have 12 months in which to complete the course, assessments included.

How much?

R12,500 per participant

Certificate

A digital certificate of completion from UCT will be awarded to students who pass all assessments with 50% or higher.

Delegates who complete the course but do not pass the assessments, will be awarded a digital certificate of participation.

Please note that the digital certificate can only be viewed on a secure portal. It cannot be downloaded or printed. You will have the option of ordering a hard copy of the certificate at your own cost, including the cost of the courier fee. More information is available here.

No certificate will be issued without the full course fee having been received. Please allow up to three weeks after the end of the course for certificates to be processed.

CPD accreditation

This course is endorsed by IISA for 17.95 points for both FAIS and professional members.

How to sign up

Complete and submit the registration form. You will then be given the payment information.

Download the brochure.