Tension in Tanzania's Gold Mining Industry

Tanzania is Africa’s fourth largest producer of gold, following South Africa, Ghana and Mali. As a result of an increase of 700% in the country’s gold production over the past 25 years, gold exports constitute 90% of the country’s minerals exports, being 22% of its total exports. Despite – or perhaps because of – the potential of this relatively new income stream, there is growing tension between the Tanzanian government and the mining industry. This follows after a series of steps taken by the country’s president, John Magufuli, aimed at maximising the benefits of Tanzania’s natural resource wealth.

In May 2016, MLiA published an article[1] on the resource-curse associated risks with Tanzania’s oil and natural gas industry. The country’s gold-mining industry is not immune to these risks either. The steps taken by the president to tighten control of Tanzania’s mining sector seem to acknowledge this fact. The below discussion sets out these steps in turn.

The first step was taken in October 2016 when new mining regulations were issued. It required holders of special mining licences to issue 30% of its company shares to the Tanzanian public and list the company on a stock exchange in Tanzania within two years. Only Tanzanian citizens or locally registered companies can purchase these shares. This establishes greater local ownership and ensures that Tanzanian citizens benefit from the country’s natural resource wealth. The deadline for the public share offering has since been brought forward to 23 August 2017, replacing the initial two-year period.

In November 2016, the president issued a statement confirming the government’s commitment to mining legislation that ensures the equitable distribution of the country’s mineral wealth. The statement made specific reference to local mineral beneficiation, instead of simply exporting the unprocessed ore.

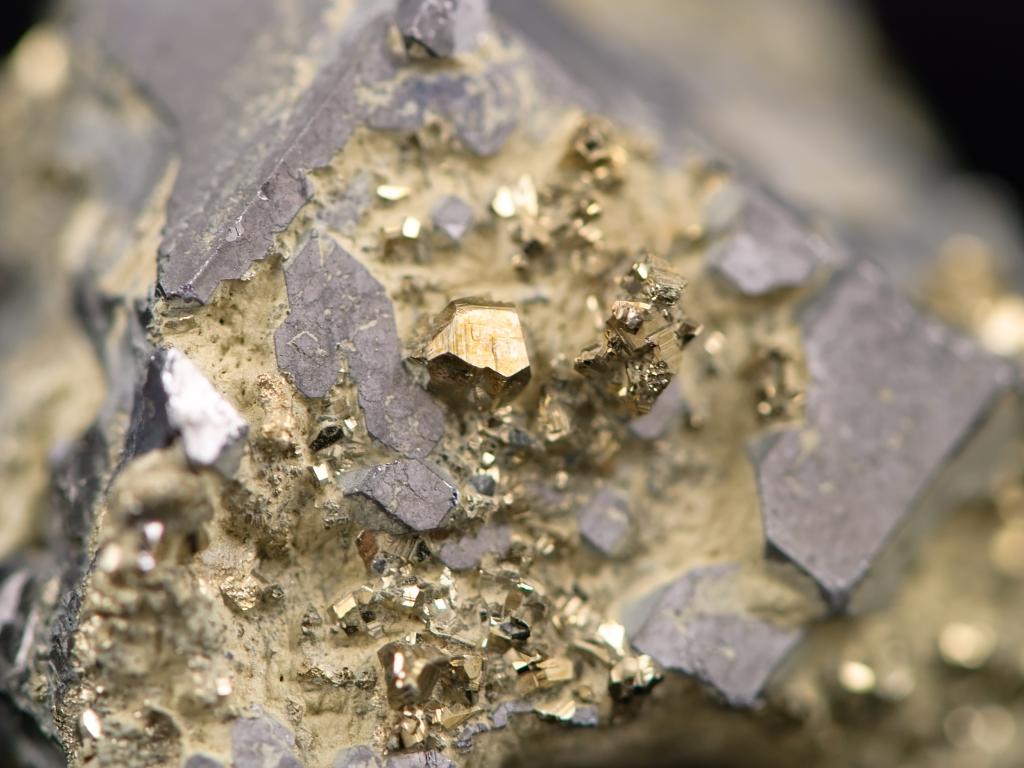

The Tanzanian government followed through on this promise when it banned the export of mineral concentrates as of 2 March 2017. In terms of the ban, ores containing metallic minerals such as gold, copper, nickel and silver must be processed locally. The government undertook to support local smelters, refineries and other stakeholders involved in mineral beneficiation. The ban prompted a warning from the Tanzania Chamber of Minerals and Energy of looming closures of some mines due to revenue losses because of the ban. It advocated for the suspension of the ban until the required local smelter(s) have become operational. The Tanzania Small-Scale Miners Association, in turn, appealed to the government to exempt small-scale and artisanal miners from the ban and impose it only against large mining companies. The Association also sighted the ban as the cause of rising unemployment. Despite these objections, the ban remains in place. Nonetheless, the government assured concerned parties that its intention was not to shake investor confidence, but rather to investigate and monitor the country’s mining industry.

In April 2017, the president continued his reform initiatives by announcing two committees to investigate the nature and value of minerals present in mineral sand bound for export. The first committee was sworn in on 1 April 2017 and comprised of eight experts from geological, chemical and scientific backgrounds. The purpose of this committee was to investigate the contents of mineral concentrates in shipping containers bound for export. On 10 April 2017, the second committee, consisting of eight lawyers and economists, was sworn in. This committee had to examine the economic impact of exporting mineral concentrates. The president assured the committees of the government’s full support and ordered all affected parties to cooperate with the two investigations. At the conclusion of the investigations, the committees released their respective reports. The findings were quite damning for the mining industry as a whole and, in particular, for Acacia Mining PLC.

Acacia Mining, listed on the London Stock Exchange, is Tanzania’s largest gold producer. The investigations found that Acacia has significantly understated its exports for a number of years, resulting in substantial revenue losses for Tanzania. Acacia has raised strong objections against these findings, calling the calculation methods into question and demanding an independent review.

Acacia was not the only party singled out by the presidential investigative committees. The reports also revealed corruption at government level, accusing local officials of concluding agreements allowing tax evasion by mining companies. In addition, the first committee’s report specifically raised the issue of local smelters and a related 2011 report of the Tanzania Minerals Audit Agency (TMAA). The TMAA is a government body charged with the monitoring and auditing of mining activities. Following an investigation in 2011 into the economic viability of a copper concentrate smelter in Tanzania, the TMAA advised against the building of a local smelter, due to the limited amount of mineral concentrate produced in Tanzania. However, the first presidential committee revealed that the relevant TMAA officials responsible for the investigation were compromised and acted in conflict with the country’s best interests. The committee recommended the construction of local smelters as soon as possible.

The committees’ damning findings prompted the president to take drastic action. On 24 May 2017, he fired the Minister of Energy and Minerals, Sospeter Muhongo, and the Energy Ministry Permanent Secretary, Justin Ntaikwa. He also dissolved the TMAA’s board of directors and suspended its CEO, Dominick Rwekaza, despite the significant increase in corporate income tax collection since the TMAA’s establishment in 2009.

The abovementioned developments have increased tensions in the mining industry, with mining companies having to operate in an increasingly hostile political climate. The government and representatives from Acacia have reportedly returned to the negotiation table. However, it is expected that it will be some time until trust is restored between the parties.

Ensuring that Tanzanian citizens benefit from their country’s wealth of natural resources is of paramount importance. Tanzania is but one example of a trend that can be observed across the African continent. Foreign mining companies often reap considerable financial rewards, while local populations receive little benefit from their country’s natural resources. They also have to bear the brunt of the environmental and social consequences of mining. Therefore, the importance of the president’s objective to ensure that Tanzanians benefit from the country’s mining industry cannot be overemphasised. However, initiatives to achieve this objective should not be so drastic as to alienate investors from the industry. It is in the best interest of the government, citizens and mining companies to find a mutually beneficial solution to continue with sustainable mining operations.

Written by Louie van Schalkwyk

[1] Luhende B “Avoiding the resource curse: Has Tanzania learned a lesson from the resource-cursed countries?”